Are you thinking about subdividing land or building a new home and selling, in Australia? Then understanding Goods and Services Tax (GST) is key, especially since it can be up to 10% of the sale price, and can impact your project in various ways.

Your intent behind the project can significantly affect your GST obligations. If you’re doing this as part of an enterprise (meaning your activity is done in the form of a business, or an adventure or concern in the nature of trade) and the intent of the transaction is to make a profit or gain, then you will likely be subject to GST requirements (i.e. paying GST on the sale price to the ATO). The ATO may look closely at whether your activities amount to an enterprise, which can include regular and continuous activities aimed at making a profit. If you’re simply selling a one-off property as a private sale, it’s possible GST may not apply, but as mentioned above, it will depend on the nature of the sale, and the intent of the seller.

The below sets out some useful information to get you thinking about potential GST implications in various circumstances:

Claiming Input Tax Credits

If you’re subdividing and/or building with the intention to sell, and GST will apply on the sale, it is beneficial to register for GST from the start so you can claim back GST credits along the way on expenses like permits, planning fees and build/construction costs. This is done by lodging business activity statements (BAS) the ATO. This can help reduce your overall costs. When making claims for expenses, ensure that you keep records of those expenses claimed.

Margin Scheme

In the case of selling subdivided land or a newly built house, it’s important to consider whether the margin scheme will apply. The margin scheme can significantly reduce the amount of GST you have to pay on the sale price. If you are eligible to apply the margin scheme, you only need to pay GST on the “margin” between the sale price and original purchase price of the land. It’s important that this is established in advance as it will need to be written into the sale contract.

Change in Use or Intent

If you change the use or intended use of a property, for instance, you build a property with the intention to sell, but then decide that it will be a rental property, this can trigger GST implications. You may need to pay back some or all of the GST you already claimed on the project.

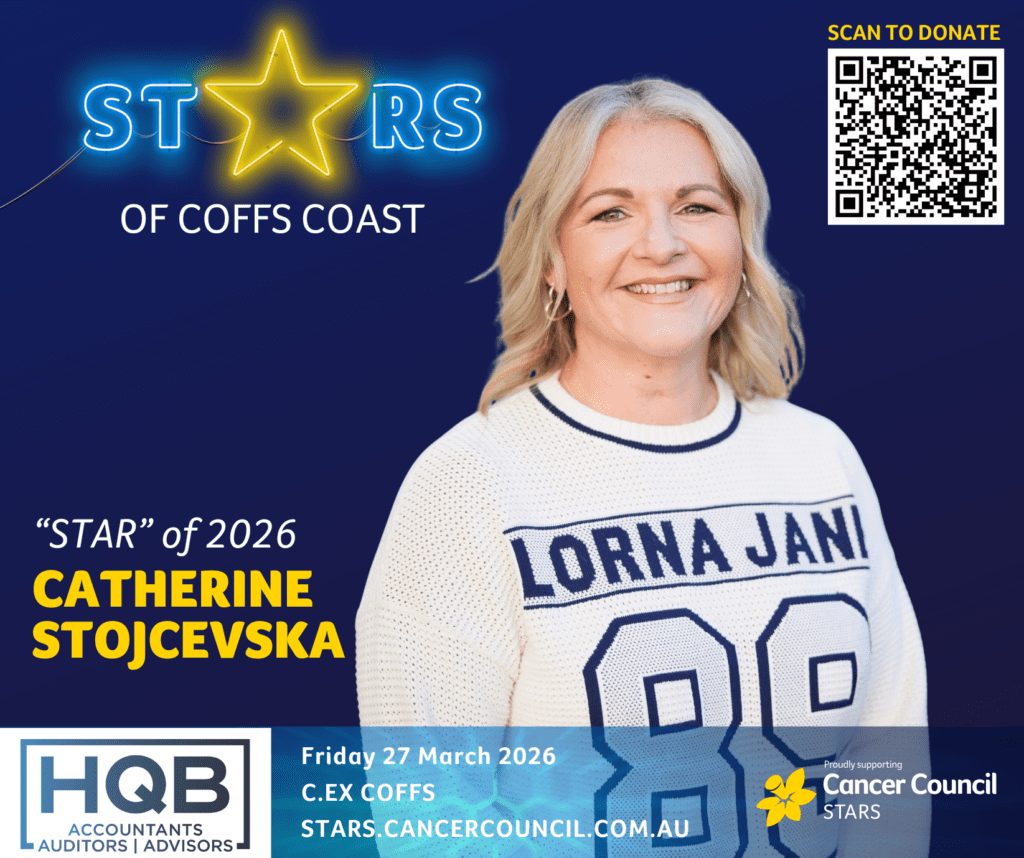

Navigating GST for land subdivision and building can be complex, and the above information is simply touching the surface, but knowing the basics can save you time and money. HQB are always here to help – if this is something you are considering we have the knowledge and experience to ensure you optimising your benefits while staying compliant along the way.

– Breana Vinecombe and Brad Sheaves

Posted 13.05.2025

This article is compiled as a helpful guide for your private information and is subject to copyright. We suggest that you do not act solely on the basis of material contained in this article because items are of general nature only and may be liable to misinterpretation in particular circumstances. We recommend that our advice be sought before acting on any of these crucial areas.